Utilizing a Health Savings Account (HSA) to finance the purchase of a reclining massage chair is an option that comes with specific conditions and limitations that must be carefully considered.

There are certain conditions and restrictions to consider to use HSA funds for such a purchase

Eligibility and Medical Necessity

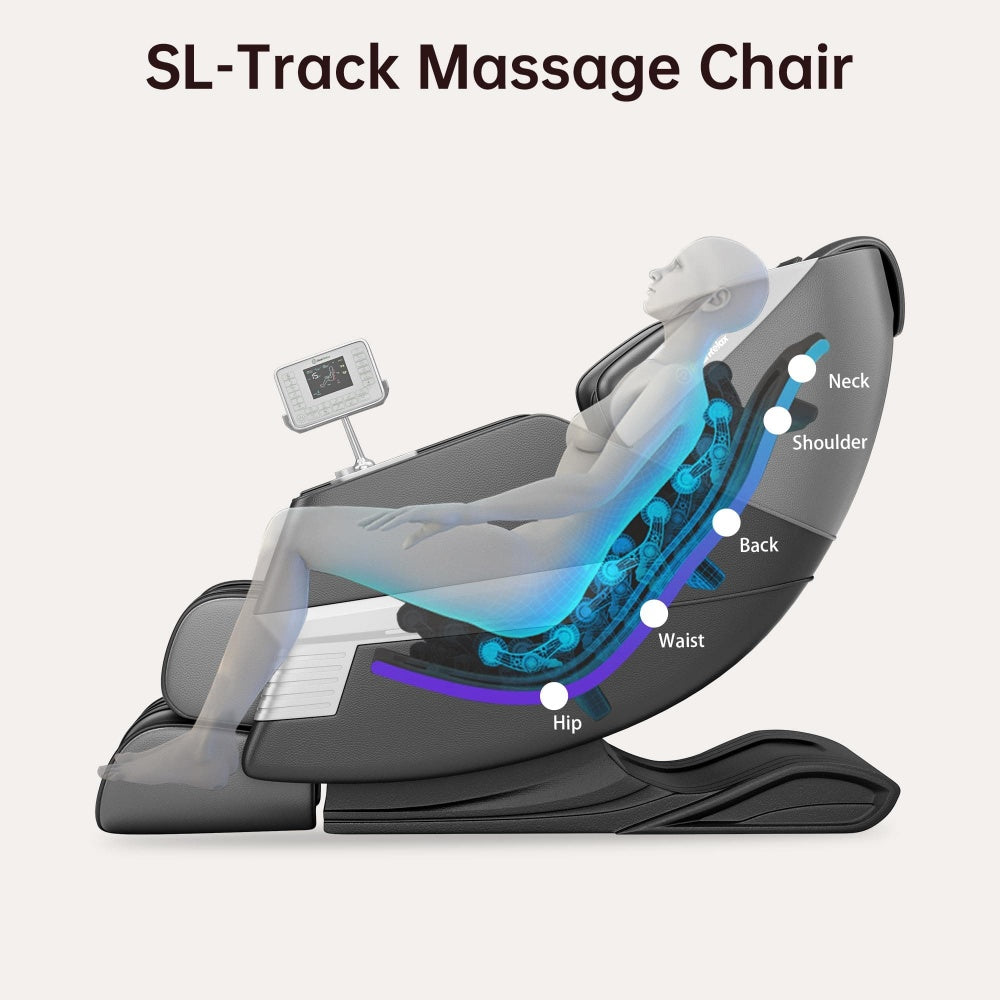

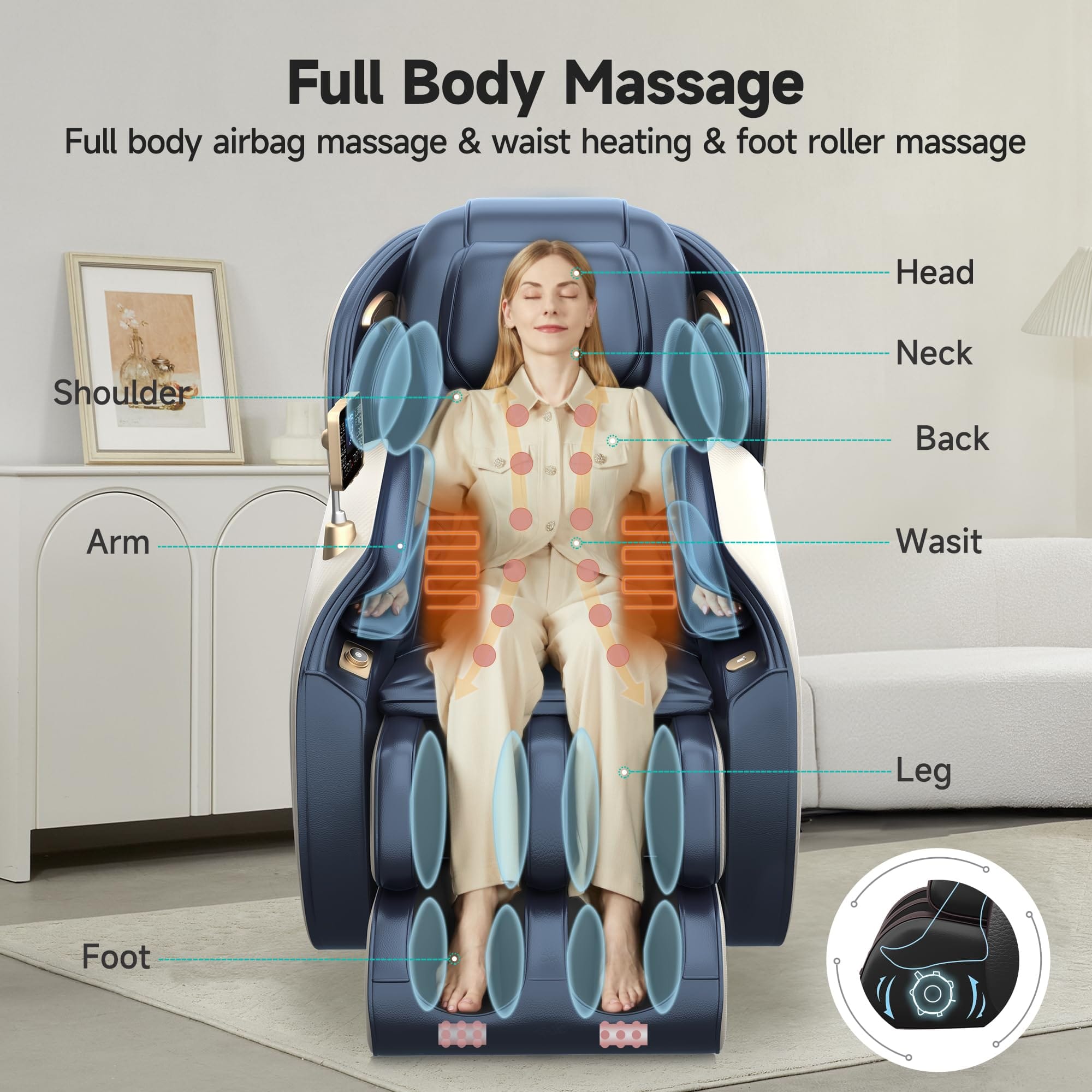

For a recliner massage chair to be deemed eligible for HSA or Flexible Spending Account (FSA) funding, it must be classified as a medical device that offers therapeutic benefits as prescribed by a healthcare professional. This classification is crucial because it allows the chair to be considered a legitimate medical expense. To meet these criteria, you may be required to obtain a Letter of Medical Necessity (LMN) from your physician. This document should clearly state that the massage chair is essential for your treatment plan and serves a medical purpose, such as easing chronic back pain, enhancing blood circulation, or diminishing muscle tension.

Variations in HSA/FSA Policies

It's important to note that HSA and FSA providers may have distinct policies regarding the use of funds for medical devices like massage chairs. The eligibility of using these accounts to cover the cost of a massage chair will depend on the specific terms set by your account provider. Therefore, it's imperative to consult with your provider to understand their policies and determine if a massage chair qualifies for reimbursement.

Tax Implications

There are tax implications to consider when using HSA, FSA, or Health Reimbursement Arrangement (HRA) funds to purchase a massage chair. If these accounts do not permit such expenditures, you may incur a 20% penalty tax in addition to income tax on the amount used for the chair. This is a significant financial consideration and should be taken into account before proceeding with the purchase.

Physician Prescription

In most cases, using an HSA to buy a massage chair will necessitate a prescription from your doctor. This prescription, along with the LMN, serves as proof that the chair is medically necessary for your health and well-being. The prescription should detail why the massage chair is beneficial for your specific condition and how it contributes to your treatment plan.

Documentation and Record Keeping

When purchasing a massage chair, it's essential to retain all receipts and documentation. These records are necessary for submitting a reimbursement claim to your HSA or FSA provider. This includes the LMN, the physician's prescription, and any other relevant medical documentation that supports the medical necessity of the massage chair.

Verification of Eligibility

Before making the decision to buy a massage chair, it's advisable to verify with your insurance provider whether the chair is eligible for reimbursement under your plan. This step can save you from potential financial penalties and ensure that your purchase aligns with the guidelines of your HSA or FSA.

In conclusion, while it is possible to use an HSA to pay for a massage chair recliner under certain conditions, it requires adherence to specific criteria, including obtaining a physician's prescription and an LMN, as well as complying with your HSA or FSA provider's policies. It is highly recommended to communicate with your healthcare provider and HSA/FSA administrator to ensure that all requirements are met before making any purchase. This proactive approach will help you avoid potential financial penalties and ensure that your investment in a massage chair is a sound one within the framework of your HSA or FSA.