When it comes to whether Blue Cross Blue Shield (BCBS) covers massage chair recliner, the answer is nuanced and depends on several factors. Here's an in-depth look at the coverage policies and how you might be able to use your insurance benefits to help offset the cost of a massage chair.

Unlikely that BCBS will cover the cost of a massage chair

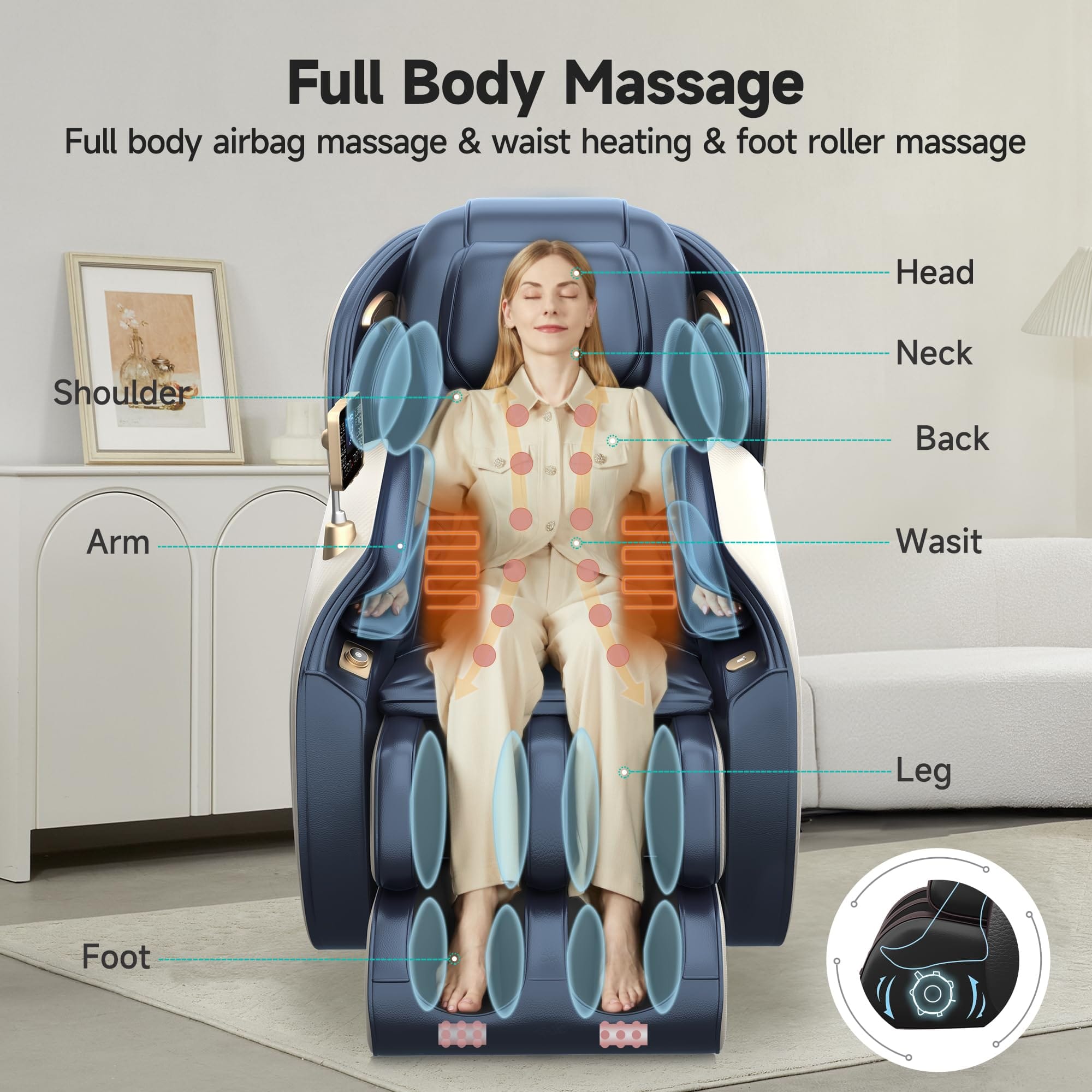

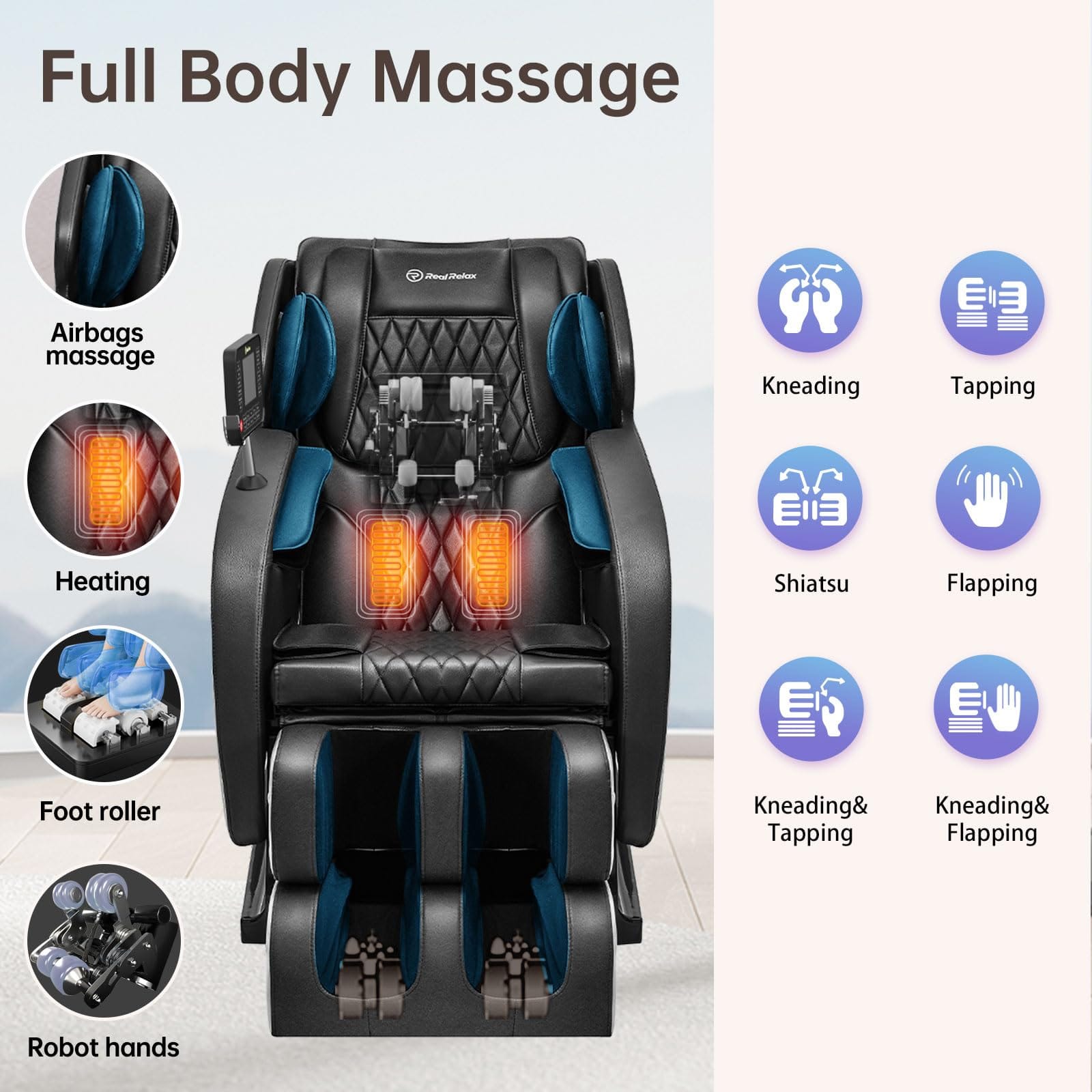

Generally, BCBS health insurance policies do not cover the cost of a massage chair as a standard benefit. Massage chairs do not have a specific medical code or classification as Durable Medical Equipment (DME) that would make them eligible for direct insurance coverage. This means that unless you have met your annual deductible and have a doctor's prescription for a therapeutic chair, it's unlikely that BCBS will cover the cost of a massage chair.

Doctor's Prescription and DME Classification

In some cases, if a massage chair is prescribed by a doctor for therapeutic purposes and is classified as DME under your plan's provisions, it might be possible to deduct the cost from your annual deductible. However, this is not a common scenario and would require specific circumstances and documentation.

Health Savings Accounts (HSA) and Flexible Spending Accounts (FSA)

While traditional health insurance may not cover massage chairs, there are other financial vehicles that might help you pay for one: HSAs and FSAs.

HSA: A Health Savings Account is a standalone medical insurance plan where you can deposit pre-tax earnings. These funds can be used for qualified medical expenses, and while massage chairs are not explicitly listed as approved expenses, they are also not on the list of excluded expenses. This means that if you have a history of chronic pain and your insurance company approves the purchase, you can use your HSA to buy a massage chair.

FSA: A Flexible Spending Account is typically offered as a supplement to a standard healthcare plan. FSAs also allow you to set aside pre-tax dollars for medical expenses. Similar to HSAs, massage chairs are not explicitly included or excluded from the list of approved expenses, so there's a chance you could use your FSA to cover the cost.

Using HSA or FSA for Massage Chairs

To use your HSA or FSA for a massage chair, you'll need to check with your insurance provider. If you have a chronic back issue and a history of claims to treat your condition, you might qualify. You'll need to get approval from your provider to ensure the purchase is considered a qualified medical expense.

Refer to articles:

Can you use HSA for massage chair?

Is Massage Chair FSA Eligible?

Can you write off a massage chair on taxes?

Documentation and Approval Process

The process for getting approval can vary, but typically, you'll need to provide a doctor's prescription and a history of chronic pain or other medical conditions that could be alleviated by a massage chair. Once approved, you can use the debit card associated with your HSA or FSA to make the purchase.

Tax Benefits and Savings

One of the benefits of using an HSA or FSA is the tax savings. Since the funds in these accounts are pre-tax, using them for a massage chair can save you up to 30% compared to paying out-of-pocket with after-tax dollars. This can be a significant incentive for those looking to invest in a massage chair for therapeutic purposes.

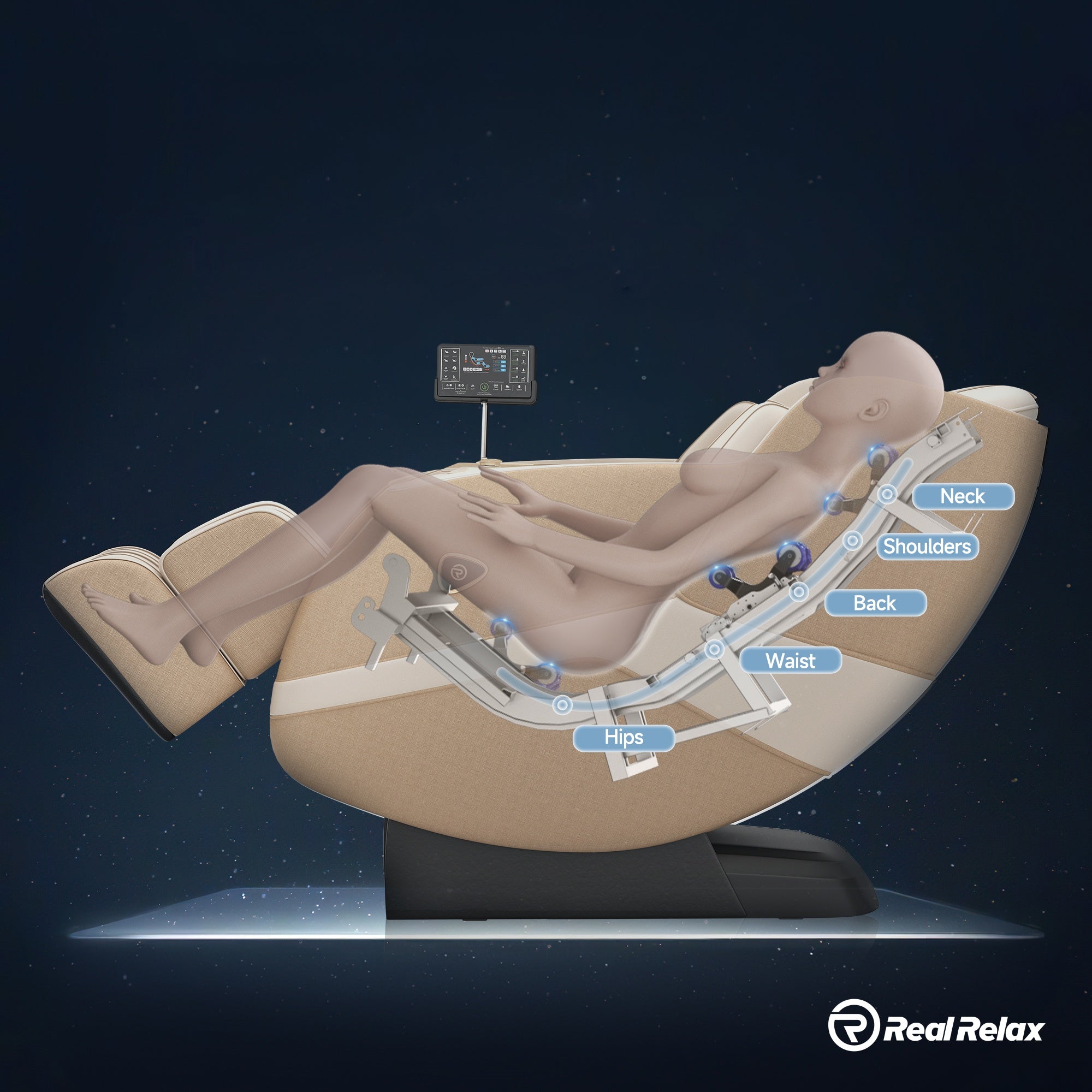

In summary, while Blue Cross Blue Shield does not typically cover recliner chair with heat and massage under their standard health insurance policies, you may be able to use a Health Savings Account or a Flexible Spending Account to help cover the cost, provided you meet certain conditions and get approval from your insurance provider. It's important to communicate with your provider, understand your plan's specifics, and explore all available options to determine if using your HSA or FSA for a massage chair is a viable solution for you.